Although debt collection is a well-established practice, the industry is still in its infancy in learning how to use and make the most of digital tools to drive successful collections outcomes.

This white paper will discuss practical recommendations for effective digital collections to enable businesses to take their programs to the next level and create a win-win for their customers and their bottom line.

Assess Your Digital Debt Collections Readiness

The world continues to move more and more toward digital solutions. Consumers are highly attached to their phones, with 70% of Americans checking their phones within five minutes of receiving a notification1Reviews.org (2022), 2022 Cell Phone Usage Statistics: How Obsessed Are We? Retrieved from: https://www.reviews.org/mobile/cell-phone-addiction/. This increase in usage combined with advancements in digital marketing practices over the last decade have enabled businesses to improve performance, particularly at acquisition and customer management phases of the customer lifecycle. Machine learning is helping identify changes to customer acquisition behaviors over time; advanced modeling is being used to predict customer risk more effectively than ever before.

However, these breakthroughs in customer communications have not yet been leveraged to their fullest extent in the collections space. With the implementation of digital marketing best practices, a collections program can become highly valuable digital-first experience for your customers and your business.

Before advanced developments like machine learning and modeling can be leveraged to its maximum benefit, it’s important for any digital collections strategy to get the basics right across strategy and analytics, targeting, and creative development.

These three areas serve as the foundation for developing any digital communications strategy, and they play a pivotal role in the overall success of a digital collections program. Within strategy, how does a program leverage each contact channel? For targeting, what are the current customer needs, preferences, and ability to pay? With creative development, how effective are the existing communication materials at conveying their message and driving action?

Strategy

How does a program

leverage each contact channel?

Targeting

What are the current customers

needs and ability to pay?

Creative Development

How effective are existing materials at

conveying their message and driving action?

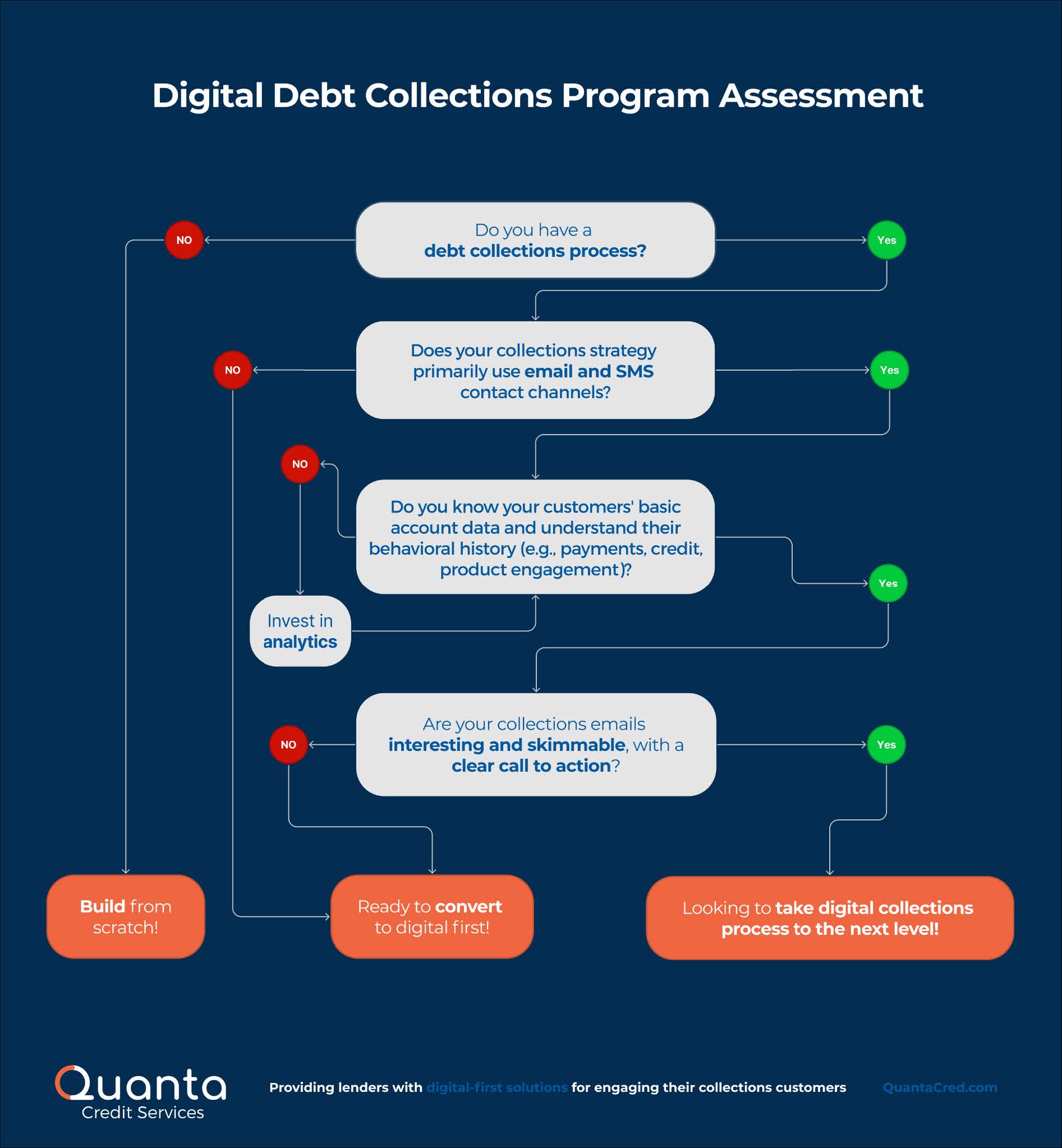

To start, establish a baseline by assessing your current collections practices along the strategy and analytics, targeting, and creative dimensions using Quanta’s Digital Debt Collections Program Assessment below.

Digital Debt Collections Best Practices

Whether your organization is building a digital debt collections program from scratch, converting a phone and mail-focused program to digital-first, or looking to take your digital collections process to the next level, there are a number of best practices that can help you along the way.

Like the acquisitions-focused digital marketing world, digital collections is all about the customer. The more an organization understands their customers’ behaviors and mindsets, the better they will be able to speak to customers using language the customers understand in order to increase payment rates. To better understand customers in collections, Quanta Credit Services recently conducted our own proprietary research2Mailchimp (accessed May 2022), The Importance of Permission. Retrieved from: https://mailchimp.com/help/the-importance-of-permission/. We found that customers generally claim personal responsibility for their bills and want to get back on track financially after unexpected expenses or overspending led to their account becoming delinquent. Individuals also have widely varied approaches to managing their debt. But one common theme our research identified is that customers will prioritize working with companies that are respectful and empathetic to their unique situation over companies they feel treated (or are treating) them poorly.

It All Starts with Permission

Before getting started, there is a critical prerequisite to a successful digital collections program – first and foremost, a digital-first outreach strategy is dependent on not only having valid email addresses and cell phone numbers, but also having consent from the customer to use those touchpoints for digital collections communications. Establishing customer consent to use email and text channels is important for two reasons:

- It’s one important step in ensuring the regulatory compliance and ongoing execution capabilities of your digital contact strategy. Email recipients have very little hesitation in reporting an email as spam if they don’t recognize the sender3Mailchimp (accessed May 2022), The Importance of Permission.

Retrieved from: https://mailchimp.com/help/the-importance-of-permission/ which can affect a program’s long term delivery capabilities. - It ensures you are starting the customer relationship off on the right foot, setting expectations about how you will communicate with them and listening when they share their expectations back to your company.

Gathering contact information and consent should happen early in the customer relationship, ideally at account origination. After that, be sure the customer’s phone number and email address is used for ongoing customer communications prior to delinquency to help enable usage upon entry to collections. Email addresses and phone numbers that haven’t been used for an extended period of time may no longer be correct for that customer and may be required to have consent recaptured.

Strategy & Analytics

Successful digital strategies are dynamic, evolving to maintain or improve performance levels as time passes. A strategy created two years ago won’t be nearly as effective as a strategy updated for the latest customer and channel insights. It’s imperative that a digital collections communication strategy iterate for continuous improvement, using analytical learnings along the way. Effective communicators know what kind of changes to implement based on observing the performance of campaigns, customer segments, and channels.

Campaign performance analytics help identify the higher and lower performing components to see where success can be expanded and where any lower performing strategies or segments should be updated to increase overall results. A holistic approach combining digital, phone, and paper channels will also be more effective than a single channel strategy.

It’s imperative that a digital collections communication strategy iterate for continuous improvement, using learnings along the way.

We recommend several key metrics to get to first level insights about the performance of an email campaign:

- Deliverability is a critical element of any email monitoring plan. Understanding your delivery rate, bounce rate, and spam ratewill help you understand if your campaigns are even getting to your customers’ inboxes. Having too many low quality email addresses or too many customers saying your emails are low quality and marking it as spam are the fastest ways to get blacklisted and become unable to send emails.

- Open Rate is not as powerful a metric as it once was after email provider and device privacy changes, but it still provides a helpful comparison across multiple subject lines and pre-headers to know what copy is most effective there to get your customers’ eyes on the actual email.

- Click-to-Open Rate tells you how effective your overall creative experience is. Is your email driving customers to take action (make a click, ultimately make a payment)? Be careful to ensure clicks counted for this metric exclude clicks from email recipients opting out.

- Opt Out Rate should typically be very low, provided you’re emailing your customers that you’ve built a relationship with who have previously consented to receive the emails you’re sending. The opt out rate is important because every opt out costs you the ability to reach that customer in the future through that channel. A higher opt out rate may indicate your strategy’s send frequency is too high.

Ultimately, the goal of an email collections campaign isn’t to drive opens or even clicks. It’s to drive a payment to the account or enrollment to an offer to resolve the outstanding balance.

Ultimately, the goal of an email collections campaign isn’t to drive opens or even clicks. It’s to drive a payment to the account or enrollment to an offer to resolve the outstanding balance.

However, total payments can take longer to measure and won’t help you isolate the key drivers of any performance lift or degradation. These first level metrics provide leading indicators about whether and how your email campaigns are engaging customers with your business but should always be used in conjunction with payment (or other primary objective) performance insights.

Knowing the performance level of your campaigns will help you identify when it’s time to refresh creatives or explore alternative segmentation. Beyond this analytical foundation, second level performance metrics can help predict things like: which channels customers will be most engaged in, what time or day drives the highest response, and which customers are most likely to pay.

Targeting & Segmentation

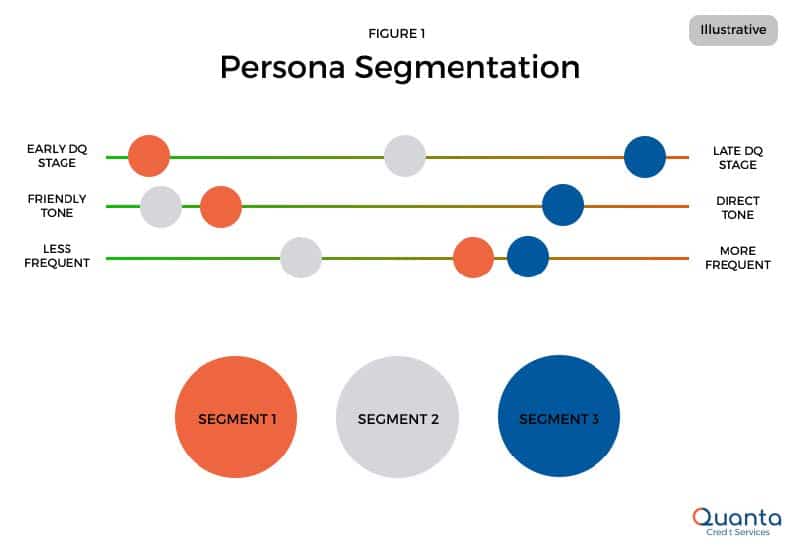

Identifying which consumers should receive which message is the goal of a digital segmentation strategy. At Quanta, we use a concept called Customer Personas4Quanta Credit Services (2022), Collections Persona Segmentation Theory. Internal document. to categorize customers and develop a customized digital outreach strategy that maximizes payments. As indicated in the assessment, knowing your customers behavioral history provides insight into how to best reach out to them in the future.

As an example, we often find a pocket of customers we call Inconsistent Payers. These customers are successfully identified by looking at their payment and delinquency history prior to the current collections entry. Typically, these customers have been in and out of collections. With a few simple reminders, however, they catch up on payments and are back to a current status before their next cycle date.

Contrast an Inconsistent Payer with a customer who has not made any payments on their account at all. For whatever reason (e.g., unexpected long-term hardship, fraud) this customer is more likely to ultimately charge off than cure and deserves a different approach and contact strategy than Inconsistent Payers.

The key to effective persona segmentation is understanding as much as possible about the motivations, feelings, and circumstances of each customer based on their account and credit history as well as their behavior.

With different types of customers, different messaging strategies are not only appropriate but valuable. Successful targeting not only helps identify which customers should receive which messages within a given channel but can also help optimize overall channel strategy to maximize payments given limited agent resources. The key to effective persona segmentation is understanding as much as possible about the motivations, feelings, and circumstances of each customer based on their account and credit history as well as their behavior.

Creative

Once you understand your customers’ motivations and situation, the communication assets, including email creatives, should be customized in response to that motivation and situation. Messaging and tone should always be aligned with your company’s broader branding and communication standards. As illustrated within Figure 1, a clear difference in the tone and strategy is warranted based on how past due a customer is. As appropriate within a lender’s Brand standards, a more lighthearted messaging strategy might make sense for an Inconsistent Payer early in delinquency. Conversely, a direct, serious tone is more likely to resonate with customers nearing charge-off, where the consequences of not paying are more severe.

Beyond tone and messaging, which should be customized for each persona and stage of delinquency, there are a number of best practices to drive customer engagement to individual email messages, as suggested by the program assessment above:

- Make it easy to read and act on: Ensure the purpose of the message is clear from the start, meaning the subject line of emails matches the intent of the message. Certain populations may respond more favorably to a direct, action-oriented approach, whereas for others, an educational tone may drive higher open rates. Additionally, most email recipients prefer to skim content rather than read it word-for-word. By breaking up text with white space, graphics, or bullets, readers can more quickly understand the intent of the communication and take action. All messages, whether email, SMS, or other digital channels should utilize a clear call to action in the copy and design elements. Use buttons or other visual tools to draw the customers’ eyes to the desired action.

- Set the right tone: It’s important that digital communications align with set brand standards to create a consistent user experience. Copy and design should suggest an honest partnership and empathetic appreciation for the customer. Customers often already know they are behind on a payment and feel a sense of responsibility to get their account up to date. However, early in delinquency, a simple email reminder about a missed payment may be all it takes to motivate a payment. In later stages of delinquency, helping the customer understand the impact of delinquency can be effective.

- Increase relevance with personalization: People can tell when they’re getting a form letter or an automated email, even if it contains personalized variables. But, personalization gives credibility to a message. Using the customer’s name indicates the message is from someone they have a relationship with. Including an account summary provides a helpful reference, saving the customer the step of logging in online to see their account status. Personalization enables an email to be more relevant to the customer receiving it.

Creative design can be an incredibly powerful tool to drive action by your customers. Keeping these best practices in mind will improve engagement and lead to strong business outcomes.

Conclusion

With the building blocks in place, your company can take the next step to moving to a digital-first collections strategy. The results will be well worth it. You will see noticeably improved delinquency and repayment results and can expect improved customer retention through more targeted and tailored experiences. Digital channels also often drive lower operations cost through a reduced (but more focused) reliance on the phone channel.

After mastering the strategy and analytics, customer targeting, and creative experience building blocks, you can explore opportunities to develop an advanced digital collections program. Expand beyond email and SMS to other customer-first capabilities, like app notifications and 2-way messaging. Introduce advanced analytics leveraging real-time modeling and machine learning for further strategy optimization. Enhance the digital inbound experience to streamline the payment experience. Keep your customers top of mind and the improved repayments will follow.

Please feel free to contact us if you’d like to learn more about Quanta’s approach to digital collections. We welcome the opportunity to continue the conversation!

About Quanta Credit Services

Quanta Credit Services is an innovative digital collections solutions provider. Quanta’s goal is to help strengthen the relationship between lenders and their customers through the most effective communication channels available. With decades of experience in both collections and digital marketing, Quanta Credit Services knows how to help lenders reach their unique customer base at the right time and in the right manner to create the digital collections win-win-win: improved collections and loss mitigation results, improved operational efficiencies, and improved customer experience. If you want to learn more about Quanta or schedule some time to discuss how you can start building or improving your digital collections strategy—visit us at quantacred.com or send an email to contact@quantacred.com.

Acknowledgements

This report was prepared by JLL Johnson, Aleks Whitchurch, Dave Wasik, and Jenn Griffin.

JLL Johnson is Quanta’s Director of Client Strategy and Operations. She is responsible for developing campaign structures, implementing segmentation, and analyzing performance to optimize future outcomes. She has over a decade of financial services experience, leading analytics teams and developing and executing digital marketing and sales strategies, most recently leading the Capital One Spark Business sales incentive, geography and reporting strategy.

Aleks Whitchurch is the CEO and Co-Founder of Quanta Credit Services – an innovative new digital collections solution provider – and a former Digital Marketing leader for Capital One’s Credit Card business. She has wide-ranging experiences with Marketing and Digital Communications channels, strategies, data, and technology and has led numerous digital-first growth initiatives. Aleks is an ardent believer in the power of integrated solutioning; she knows that bringing together the best of Digital Communications with industry-leading Collections expertise will enhance collections outcomes for both borrowers and lenders.

Dave Wasik is a Partner at 2nd Order Solutions and former senior executive at Capital One with over 25+ years of experience in consumer credit. At 2OS, he has led > 50 engagements spanning the full credit lifecycle with a particular focus on Collections and Loss Mitigation. Dave also led Collections and Recoveries for Capital One’s card and personal loan business during the Great Recession and was one of a handful of Senior Credit Officers while at Capital One. Dave is a Co-Founder of Quanta Credit Services and serves as a board member and strategic advisor.

Jenn Griffin is Quanta’s Creative Director. She is a professional visual communicator passionate about helping businesses and organizations reach their target audience through creative design and strategic branding. Well-versed in all aspects of marketing and organizational communication, she brings a proven ability to manage both people and projects from inception to completion on time and within budget.

You may contact the authors by email at:

Source Citations:

- 1Reviews.org (2022), 2022 Cell Phone Usage Statistics: How Obsessed Are We? Retrieved from: https://www.reviews.org/mobile/cell-phone-addiction/

- 2Mailchimp (accessed May 2022), The Importance of Permission. Retrieved from: https://mailchimp.com/help/the-importance-of-permission/

- 3Mailchimp (accessed May 2022), The Importance of Permission.

Retrieved from: https://mailchimp.com/help/the-importance-of-permission/ - 4Quanta Credit Services (2022), Collections Persona Segmentation Theory. Internal document.