Challenges, Opportunities, and the Unconventional Uses of BNPL

In recent years, the Buy Now, Pay Later (BNPL) trend has rapidly gained popularity, reshaping the way consumers approach their purchases. Offering a convenient and flexible payment option, BNPL services have become the go-to choice for many, with a significant impact on various consumer demographics.

What Patterns to Look for with BNPL

The finance industry is well aware of the sky rocketing use of Buy Now, Pay Later crowd. In fact, brand new Black Friday numbers show that in the month of November (Nov. 1–Nov. 26) 7.3 BILLION dollars were spent using BNPL services. Now that consumers know that it is a dependable option with holiday shopping, it is important to anticipate what the climate will be like in 3 months down the road. To do that, ask some questions:

- What is repayment like for this credit line?

- Who is most likely to pay versus most likely to overdo their spending?

- Are there indicators for what is bought using BNPL that can show which persona they fall into?

Quanta Credit Services know the need to understand the consumer base (persona definition is one part of how we boost our client’s collections), so we have broken down the most important aspects of the 2023 research on BNPL credit. Recognizing trends allows an inside look at what the underlying motivations are for those we are looking to influence, such as how to be top of wallet in collections.

Analyzing research surrounding BNPL usages allows companies to challenge assumptions or cement discoveries from previous years. First and foremost, repayment is an important number to pay attention to.

Out of all users of BNPL, 40% have had a late payment.

This is a startling stat, making it even more important to recognize why BNPL is being used, by whom, and how to best help the consumer stay on track with their payments. Using data to back our insights, Quanta can help you determine what is driving your customers, which in turn can help educate how to best motivate repayment.

Who Utilizes BNPL?

According to 2023 data, a striking 46% of Americans have utilized a BNPL option at some point in their shopping ventures. This points to the widespread adoption of this payment model across the nation as it continues to grow year over year.

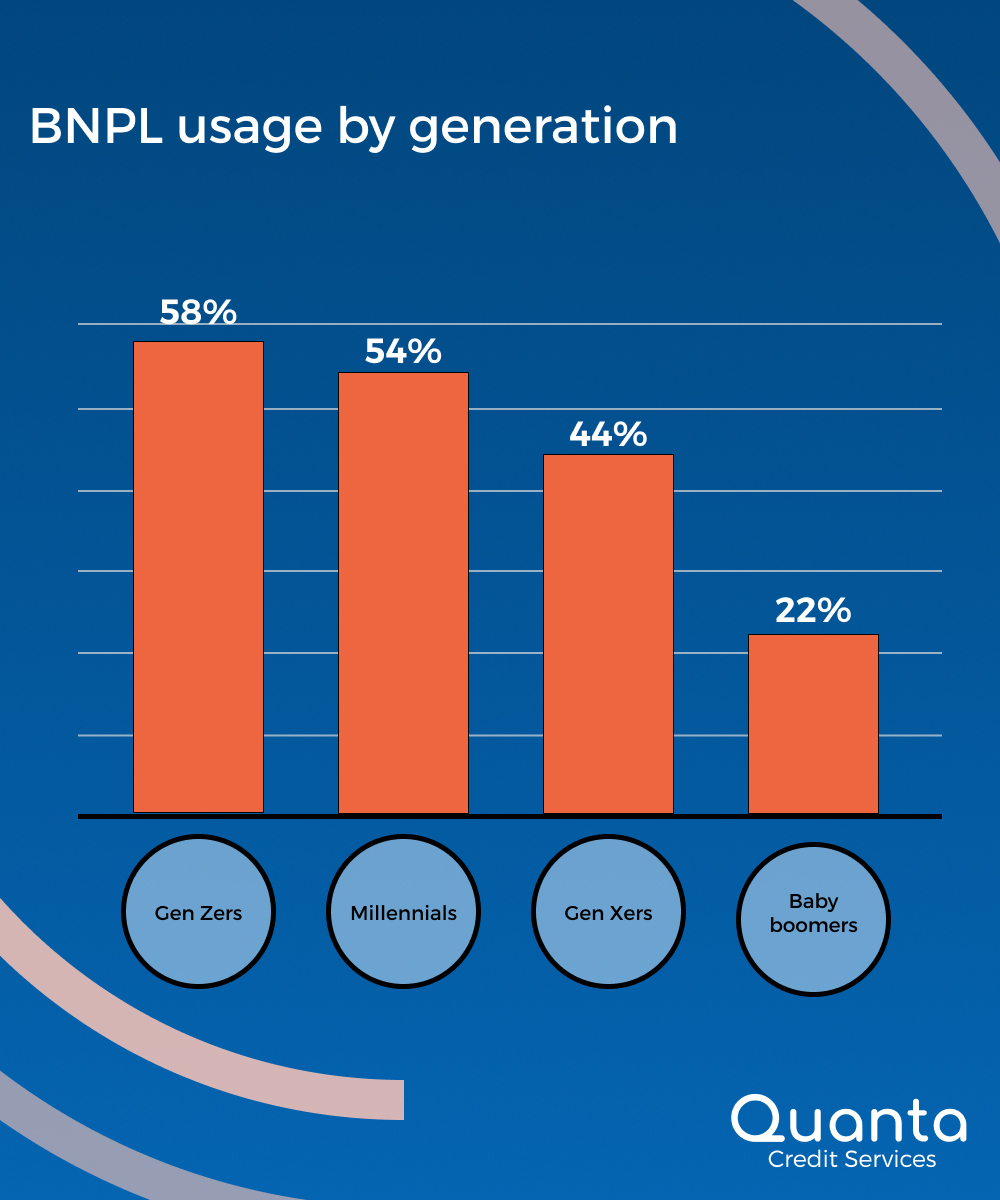

BNPL Compatibility with Different Generations: How Shopping is Changing

However, when it comes to generational preferences, a notable divide emerges. Almost 2/3 (65%) of Generation Z individuals have embraced BNPL services, showcasing a clear inclination towards this payment method, and Millennials are not far behind at 55%. Whereas only 24% of baby boomers have chosen to utilize BNPL, indicating a generation gap in acceptance and adoption.

In 2023 the Generations are defined as follows:

- Generation Z: 18 to 26

- Millennial: 27 to 42

- Generation X: 43 to 58

- Baby boomer: 59 to 77

“The younger you are and the higher your income, the more likely you are to use BNPL, generally speaking”. This is important to note that dealing with delinquency and a younger demographic means leaning more towards a robust digital strategy for collections success. Using these trends to create operational strategies is important for any collections department dealing with BNPL use cases.

BNPL is most popular among young people, but are there any other noticeable trends?

BNPL Usage Trends That Might Surprise Some

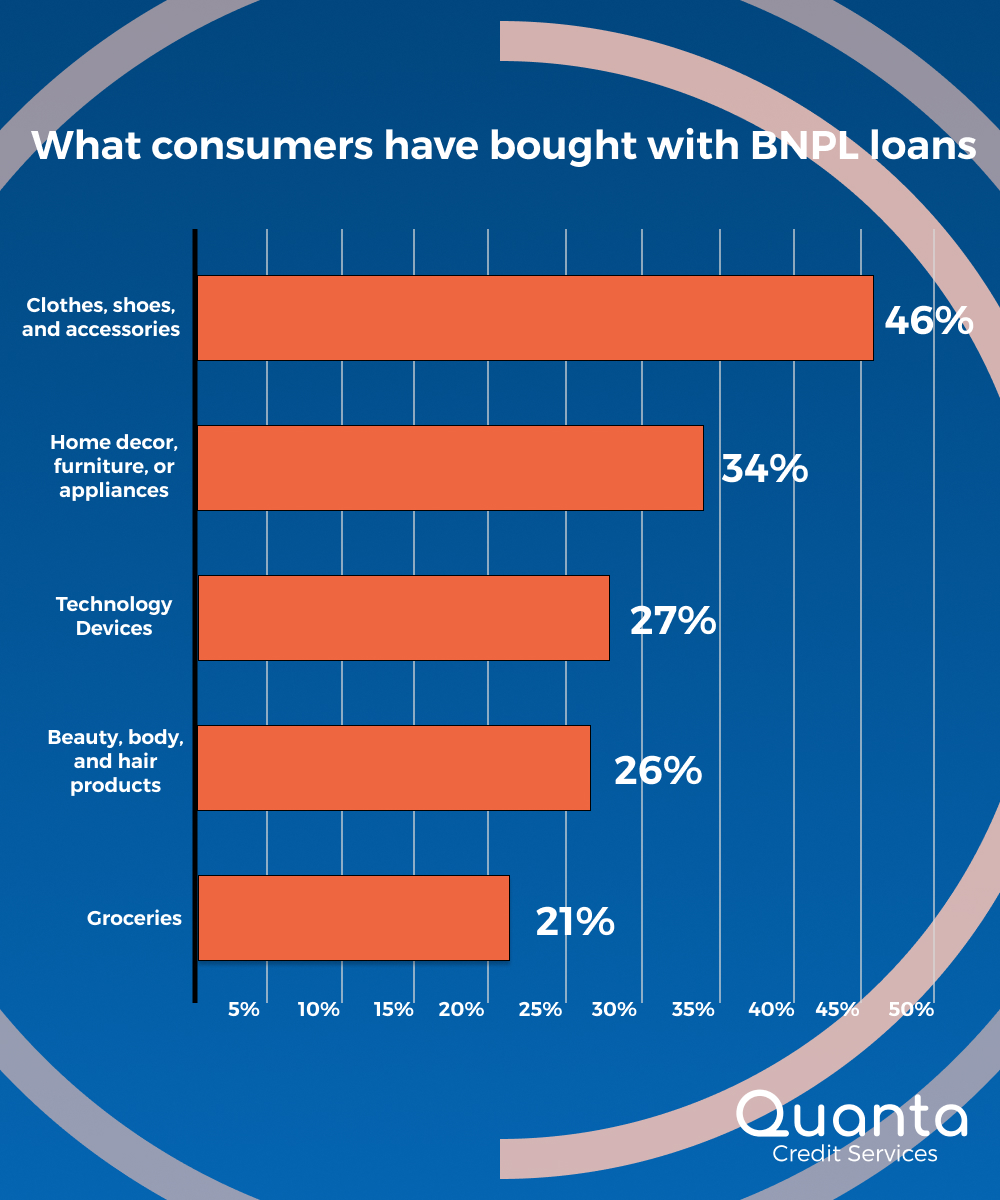

A surprising understanding lies within the top 5 usages with BNPL. Ranking in the top 5 for what consumers have used BNPL to purchase, groceries come in at 21%, which challenges the assumption that BNPL is only for larger purchases of merchandise. More than 1 in 5 users have taken advantage of the point-of-sale financing for groceries.

The top use of BNPL is clothes & accessories, and the second highest use is for home furnishings or appliances, making it a reliable use for:

- Holiday season shopping

- Out of the ordinary spending

- Splurging for something big

What do consumers use BNPL to purchase?

Additionally, to note that while Buy Now, Pay Later can be used for extravagant expenses, it can also be used to bridge the gap in between pay checks for groceries or to make needed repairs to a home.

Repayment Patterns with BNPL

NPL is most popular among younger people and can be used for a wide array of purchases. Yet, no matter what the purchase is used for, a large majority of BNPL users end up being charged on top of the purchase with late payments and fees.

BNPL can be a tool to stretch the budget, which is why it is not surprising that regrets are common among users after struggling with late payments. Important stats to look at when taking a deeper dive into who is most likely to have paid late:

- Parents with kids younger than 18 are among the most likely BNPL users to have paid late (49%)

- Gen Zers ages 18 to 26 (45%)

- Millennials ages 27 to 42 (45%)

- Borrowers making $100,000 or more a year (45%)

The numbers do not lie, and neither do the late loan payments on credit lines. With a diverse crowd of prominent late payments, reasoning asks “Why use BNPL”?

Why Use BNPL?

Buy now, pay later can be beneficial in a tight spot, they’re fast to get, predictable with breakdowns of payments (pay-in-four), and often interest free. When a customer is surprised by the total payment needed (and who isn’t in the time of 2023 with high inflation rates), BNPL offers a lesser amount at the point-of-sale to ease the consumer’s mind. What seems like an easy fix for a sticky situation can lead to quickly stacking up “paying later” when the time comes, making it difficult to pay back.

Additionally, these types of trade lines are not credit reported, which may be a reason they are becoming a preferred payment method. On the lender side, without the credit report feature for this product, traditional lenders do not get a clear picture of what customers may owe. This creates a confusing and ever-changing landscape with loan repayments.

After combing through the statistics, we stress the importance of a robust digital communications strategy when outreaching these clients. They are tech savvy individuals who may or may not know the conditions of the payment — just that it made their purchase more manageable at the time.

If your business needs assistance in how to better communicate with your consumer about paying back their BNPL obligations, Quanta Credit Services can help. We offer 3 different packages, custom digital creatives, and a team that will help elevate your collection services.

The surge in Buy Now, Pay Later (BNPL) usage has undeniably transformed the landscape of consumer spending, particularly during the holiday season. As we navigate the evolving trends, it becomes imperative to delve deeper into the motivations and patterns of BNPL users. Quanta’s data-driven insights empower businesses to understand their customers better, enabling them to navigate the challenges of late payments and tailor strategies that resonate with diverse demographics.

The statistics reveal a fascinating dichotomy in BNPL adoption across generations and shed light on unexpected usage trends. While younger generations enthusiastically embrace this payment model, the surprising prevalence of BNPL for groceries challenges preconceived notions. As we navigate the complexities of this financial tool, it’s crucial to recognize its dual nature — a convenient budget stretcher and a potential source of regret when not managed wisely. By understanding the intricacies of BNPL, businesses can not only stay ahead of consumer preferences but also contribute to a more informed and financially savvy consumer base.