Although debt collection is a well-established practice, the industry is still in its infancy in learning how to use and make the most of digital tools to drive successful collections outcomes.

This whitepaper will discuss common barriers businesses face in developing a digital-first debt collections program as well as how businesses can overcome these barriers to make immediate improvements to their strategies and empower customers to more clearly understand and take action.

The Future of Collections Is Digital-First

The collections industry has taken a phone-first approach for decades, relying on customers being available and ready to respond to collections activity at the lender’s time of choosing. Over time, this has created a consumer experience that often goes beyond unpleasant, causing overwhelming feelings of frustration and shame for customers1Quanta Credit Services (2022), Collections Qualitative Consumer Research. Unpublished internal document.. It has also led to increased regulation and scrutiny of the debt collections industry. Moving to a digital-first collections strategy is critical to positively engaging customers and driving strong business results for years to come. When used appropriately, digital servicing tools can reduce a customer’s negative feelings and prompt the customer to understand that their lender is there to help.

There are many external factors that are pushing the industry to embrace digital collections:

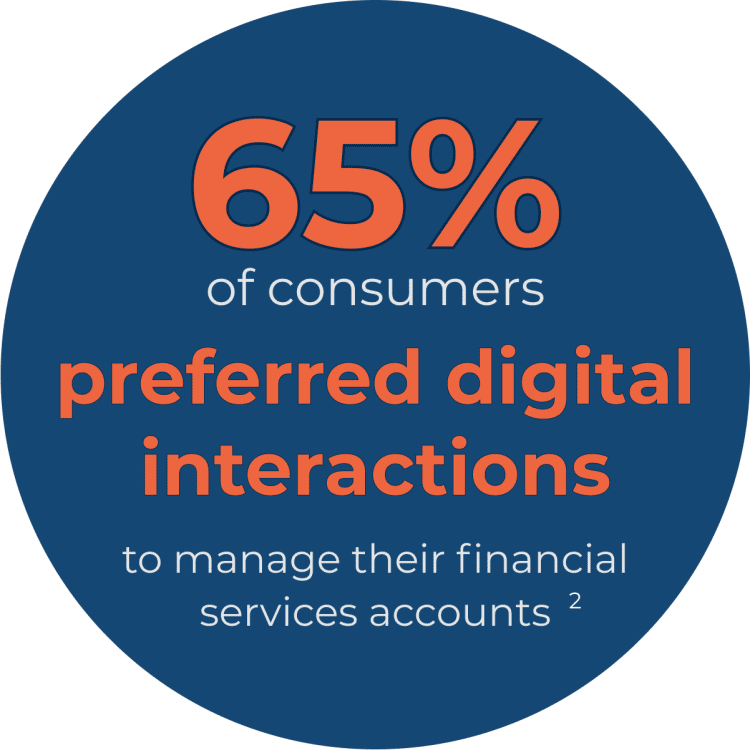

Consumers prefer digital. Even before the pandemic, 65% of consumers preferred digital interactions, like SMS texting, to manage their financial services accounts 2Avochato (2019), Study Shows U.S. Customers Prefer Texting With Businesses, PR Newswire. Retrieved from: https://www.prnewswire.com/news-releases/study-shows-us-customers-prefer-texting-with-businesses-300974034.html. Now digital interactions are increasingly possible, with the percentage of email-eligible accounts in collections increasing from 68% in 2018 to 84% in 2020 3Bureau of Consumer Financial Protection (2021), The Consumer Credit Card Market (pp. 9, 40, 42, 133) Retrieved from: https://files.consumerfinance.gov/f/documents/cfpb_consumer-credit-card-market-report_2021.pdf. Live chat services are also quickly gaining ground as another convenient way for customers to quickly get less sensitive and less complicated account questions answered.

- New CFPB regulations put limits on frequency of outbound calls, but explicitly allow outbound digital communications through both email and SMS.

- The advancement of call blocking and caller ID technology has made outbound calling dramatically less effective compared to five to ten years ago.

Lenders and debt collection agencies are likely also facing internal factors that increase the appeal of a digital-first collections strategy:

- Hiring great talent is harder than ever. According to a 2021 LinkedIn study, the median time to hire is 40 days across a variety of industries and takes even longer in specialized fields 4LinkedIn (2021), Can you wait 49 days? Why getting hired takes so long in engineering. Retrieved from: https://www.linkedin.com/pulse/can-you-wait-49-days-why-getting-hired-takes-so-long-george-anders/.

- With uncertainty about the future trajectory of delinquency rates, digital collections strategies can serve as a staffing “shock absorber” to avoid sudden needs to staff up call centers.

- Companies where more collections associates are now working from home have seen noticeable decreases in their productive-to-paid rates 5Quanta Credit Services (2022), Client Engagement Trends. Unpublished internal document.

- Incentive policies continue to be under heightened scrutiny, limiting that tool’s effectiveness at driving productivity.

Now is the time to invest.

For now, credit card losses and delinquencies are at their lowest level in decades 6Bureau of Consumer Financial Protection (2021), The Consumer Credit Card Market (pp. 9, 40, 42, 133) Retrieved from: https://files.consumerfinance.gov/f/documents/cfpb_consumer-credit-card-market-report_2021.pdf. Leading lenders are building out their digital collections capabilities, knowing that as stimulus and loan forgiveness programs expire, delinquency volumes will revert to pre-pandemic norms some time during 2022.

A successful digital-first approach to collections puts the customer at the forefront, centering the strategy, operations, and experience around the individual consumer’s circumstances and communication preferences. Collections can be a difficult customer journey. Taking an approach that centers around the customer’s needs and preferences allows the customer to feel in control, improving the customer experience, and increasing post-collections customer retention and positive sentiment. Well-designed digital collections strategies that put the customer at the forefront create a “win-win-win” situation for lenders, with benefits across loss mitigation, operating expenses, and customer experience. This combination of higher revenue and lower costs with the added benefit of an improved experience, ultimately leads to higher profitability.

Well-designed digital collections strategies that put the customer at the forefront create a “win-win-win” situation for lenders, with benefits across loss mitigation, operating expenses, and customer experience.

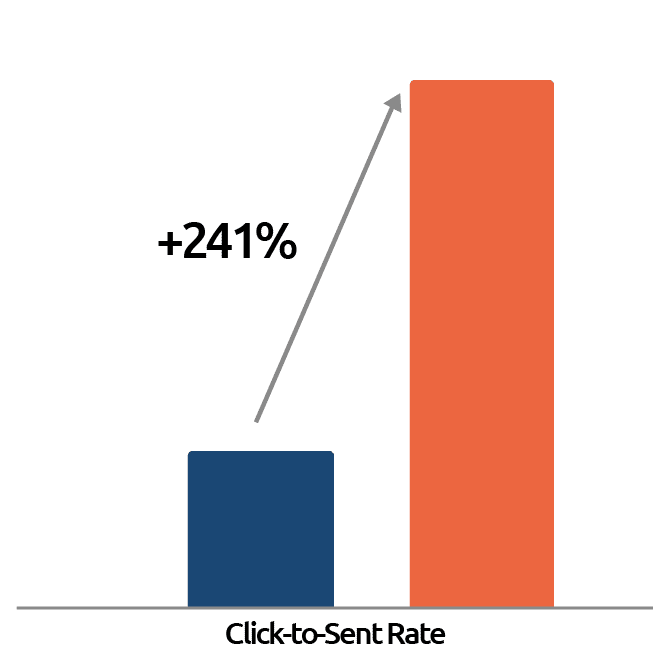

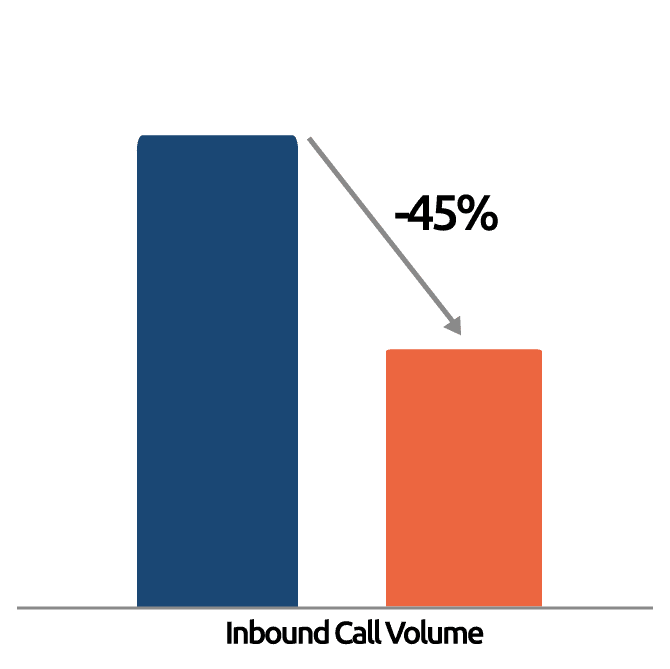

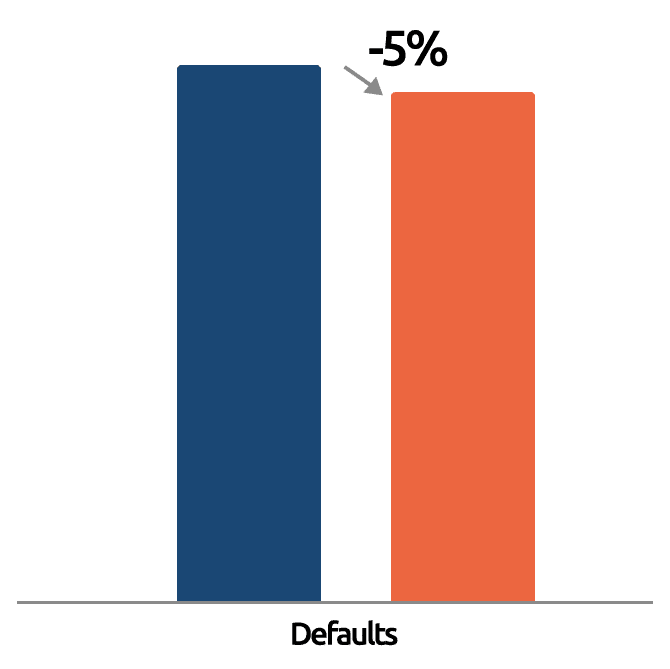

The proof is in the results. In a recent engagement conducted by Quanta Credit Services, implementing a foundational digital-first collections strategy drove 3X higher click rate, decreased inbound call volume by nearly half, and led to a 5% reduction in overall defaults compared with the client’s existing strategy 7Quanta Credit Services (2022), Client Engagement Trends. Unpublished internal document. The Quanta Effect drove increased digital engagement, decreased operations expense, and higher repayments — creating real value for our client’s bottom line.

Overcoming Common Barriers to Create a Successful Digital Collections Program

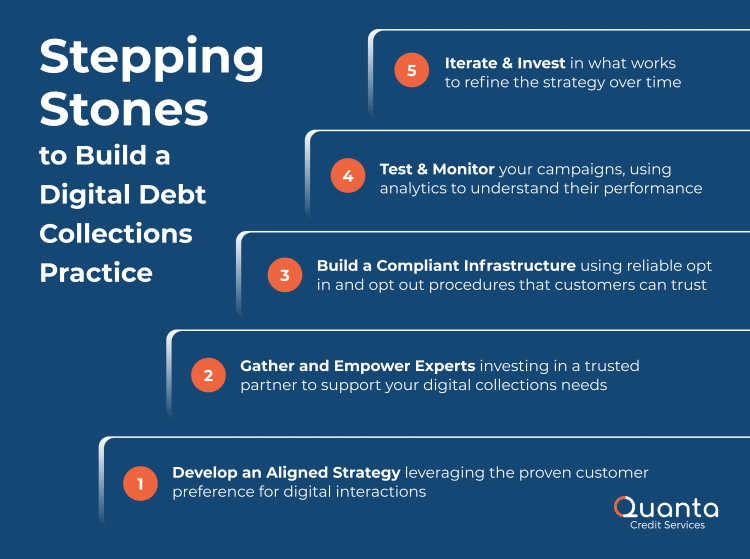

Creating a digital-first collections program can seem like a daunting task, especially if an organization hasn’t focused on digital communications previously. From creating an effective strategy to getting the implementation technology up and running, there are a number of barriers that make it challenging to start. Below are a few obstacles we commonly hear and ways to think about overcoming each one. As your organization overcomes each barrier, you develop the stepping stones to a highly effective and sustainable digital collections program.

Barrier #1: My company hasn’t had success with digital communications previously. I’m not even sure digital collections works!

Answer: Digital engagement with financial service products is growing consistently across all customer segments and nearly every platform type 8Bureau of Consumer Financial Protection (2021), The Consumer Credit Card Market (pp. 9, 40, 42, 133) Retrieved from: https://files.consumerfinance.gov/f/documents/cfpb_consumer-credit-card-market-report_2021.pdf. Consumers under 25 continue to have the highest digital engagement, but consumers ages 25-64 as well as 65 and older increased their digital activities compared with prior years. Consumers are clearly indicating to lenders their preference for digital interactions over phone calls and letters, most likely as a result of being able to set the terms of that interaction. Consumers can open and respond to an email or SMS at their convenience vs. answering the phone whenever it rings. Previous lack of success is likely more of an indication that the strategies and creatives used were not well aligned to these new and unique channels. We recommend continued testing and learning in this continuously evolving space.

Barrier #2: My collections leaders have an extensive call center background, but this seems like a branding/marketing problem. How do I pull in the right marketing/communications expertise to help me build out these channels?

Answer: A successful digital collections strategy requires the right combination of collections analytical expertise, brand and marketing experience, and digital execution knowledge, along with strong operations support. We recommend seeking out and engaging with experienced and qualified talent in these areas who have proven results. The collections and analytics expert ensures that the strategy reflects the unique needs of both the business and its customers. This expert enables analysis, testing, and monitoring to drive continuous strategic improvement over time. A team member with brand experience ensures that any messaging is consistent with the expected customer experience, including the look and feel of messages. The digital expert translates the strategy and creatives into executable files and schedules. A great operations team with a compliance focus ensures the long-term sustainability of your strategies. Hiring the right internal associates or external partner(s) can enable you to implement a great segmentation strategy, targeting the right specific customers in the right channel with tailored creatives to drive customer action and ultimately payments.

Keep in mind: a fully in-house solution isn’t necessary. You can start taking steps towards digital through partnerships, outsourcing, and testing. There are a number of companies, including Quanta Credit Services, which will create and implement a digital-first collections solution with limited tech resources required. With a regular data feed and as much or as little input as you prefer, a successful provider will partner with you to create an outsourced solution to meet your collections needs with the costs more than offset by increased payments and improved customer retention. Quanta supports clients where they are, whether they need analytics and segmentation support, a creative overhaul, digital execution resources, or any combination. A great external partner provides a one-stop solution for your digital collections strategy.

Barrier #3: I’m on board with the need for digital collections, but I don’t have reliable opt-in and opt-out processes for use of email and SMS channels.

Answer: Reliable opt-in and opt-out procedures are a critical component of a compliant digital collections infrastructure. Permission to engage over email and text channels are the foundation for successful and compliant engagement with customers.

- Opt-ins can be collected for new customers by including language within the customer agreement at account set-up to opt in to digital communications. For existing customers, provide the ability to opt in during a servicing interaction, like a website sign-in or servicing phone call. Once customers agree to digital interactions, opportunities for collections efficiencies are endless.

- As a best practice, customers should be provided with the opportunity to opt out of communication channels as a way to indicate their preferences. The opt-out method needs to be reasonable and simple. Customers who opt out should be removed from future communications in that specific channel as quickly as possible to maintain a strong and compliant customer experience. If considering a service provider to handle email and SMS communications, ensure they have appropriate opt out procedures in place.

Barrier #4: I’m getting really low customer engagement from my collections emails. How can I go digital-first if my customers won’t open my emails? How do I set the right email and SMS cadence to avoid creating fatigue for my customers?

Answer: Low engagement rates are a consistent challenge across the industry. In 2020, the CFPB reported an average email open rate of debt collections email of only 32%3. Monitoring and understanding your digital performance is the first step to improving that performance.

Investment in the strategy details and emails themselves will improve opens and clicks:

- Identify the optimal day and time to send the emails

- Ensure the subject line and preheader get the reader’s attention to open the email

- Ensure imagery, iconography and logos are on brand to create trust from the consumer that the email is from who it says it’s from

- Adopt best practices about the content and call to action to achieve more clicks (and ultimately more payments).

Customers may feel message fatigue leading to opt outs for a number of reasons, including some in your control (e.g., sending too many messages in too short a time) and some outside of your control (e.g., customers perceive too many total emails in their inbox over a period and decide to unsubscribe from several senders at once). It’s critical to test your way into an increased send frequency with clear monitoring to quickly identify when opt outs pass your acceptable threshold. The ideal strategy will vary from business to business and customer to customer, but testing and monitoring will give you the best insight into what works best for your customer base.

Barrier #5: I was getting strong results for a while, but recently performance has been declining. How do I prevent performance degradation in my digital collections strategy?

Answer: Performance degradation is a common challenge faced by digital strategies across all industries. What works well today won’t be relevant a year from now because the digital ecosystem (and how consumers participate in it) continues to rapidly evolve. Expect to regularly update all aspects of your digital strategy, including the creative assets, the cadence and timing of sends, the segmentation attributes, and even the channels being leveraged. This does not mean starting from scratch every month or quarter! Take advantage of your rigorous monitoring and analytics, and use those insights to isolate exactly which elements of the program are no longer performing well. Perhaps your emails need new subject lines, or the timing of your SMS sends no longer matches when your customers are ready to take action. Maybe a new email template with a high click rate can also be successfully used in other segments. Over time, small updates and iterations to refine your strategy will help to not only maintain performance but improve it.

Let’s recap

It’s a new year and a fresh chance to increase payments and reduce costs in collections by leveraging digital communications more effectively. Incorporating these best practices can improve the collections bottom line while creating a more positive customer experience, which is a win-win for everyone.

Not sure exactly what your next move is? Stay tuned for Quanta’s next publication which will feature a quick and easy self-assessment and some of the foundational building blocks of a lasting digital collections strategy.

About Quanta Credit Services

Quanta Credit Services is an innovative digital collections solutions provider. Quanta’s goal is to help strengthen the relationship between lenders and their customers through the most effective communication channels available. With decades of experience in both collections and digital marketing, Quanta Credit Services knows how to help lenders reach their unique customer base at the right time and in the right manner to create the digital collections win-win-win: improved collections and loss mitigation results, improved operational efficiencies, and improved customer experience. If you want to learn more about Quanta or schedule some time to discuss how you can start building or improving your digital collections strategy—visit us at quantacred.com or send an email to contact@quantacred.com.

Authors:

JLL Johnson, Director of Client Strategy and Operations

Aleks Whitchurch, CEO and Co-Founder

Dave Wasik, Co-Founder and Board Member

Visual Design:

Jenn Griffin, Creative Director

March 2022

Source Citations:

- 1Quanta Credit Services (2022), Collections Qualitative Consumer Research. Unpublished internal document.

- 2Avochato (2019), Study Shows U.S. Customers Prefer Texting With Businesses, PR Newswire. Retrieved from: https://www.prnewswire.com/news-releases/study-shows-us-customers-prefer-texting-with-businesses-300974034.html

- 3Bureau of Consumer Financial Protection (2021), The Consumer Credit Card Market (pp. 9, 40, 42, 133) Retrieved from: https://files.consumerfinance.gov/f/documents/cfpb_consumer-credit-card-market-report_2021.pdf

- 4LinkedIn (2021), Can you wait 49 days? Why getting hired takes so long in engineering. Retrieved from: https://www.linkedin.com/pulse/can-you-wait-49-days-why-getting-hired-takes-so-long-george-anders/

- 5Quanta Credit Services (2022), Client Engagement Trends. Unpublished internal document

- 6Bureau of Consumer Financial Protection (2021), The Consumer Credit Card Market (pp. 9, 40, 42, 133) Retrieved from: https://files.consumerfinance.gov/f/documents/cfpb_consumer-credit-card-market-report_2021.pdf

- 7Quanta Credit Services (2022), Client Engagement Trends. Unpublished internal document

- 8Bureau of Consumer Financial Protection (2021), The Consumer Credit Card Market (pp. 9, 40, 42, 133) Retrieved from: https://files.consumerfinance.gov/f/documents/cfpb_consumer-credit-card-market-report_2021.pdf