Every year around this time the inevitable occurs in the collection and recovery space; tax season comes to an end.

The decrease in collections following tax season is often compounded by the reduction of resources that occurs as tax season comes to a close. This leads to negative outcomes for issuers and agencies alike.

With the influx of delinquencies that is occurring in the early-stage collection space right now, a reduction in collection resources could lead to significant losses in an already precarious economic situation.

In the collection space, staffing continues to be problematic as phone agent and collector positions remain vacant due to the current state of the job market. The unemployment rate remains historically low at 3.6% (as of February 2023). Average hourly wages continue to put pressure on profitability and staffing models with the average hourly rate in the US up 4.6% from a year ago to $33.09, according to the Department of Labor.1https://www.bls.gov

TransUnion reported that bankcard balances have risen for the 11th month in a row, while 30, 60, and 90 delinquencies have all increased 7-8 basis points individually.2TransUnion January 2023 Credit Industry Snapshot

What should you do next?

The collections industry has always found ways to increase output in the face of challenges. Automated dialers, human contact initiated calls, and voicemail drops are all great examples of the collections industry increasing output. However, the industry, in both collections and recoveries, has been slow to introduce and fully utilize non-voice contact channels for collections. In collections, this has often been due to a resource constraint. In recoveries, this has been limited often due to risk or ability.

With the rising delinquencies across financial services; an immediate investment in

- Analytics

- Inventory management

- Digital outreach

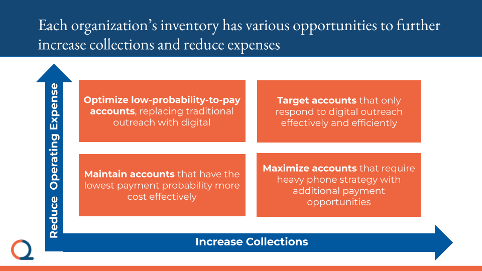

The right content at the right time to the right customer will drive increased collections and reduced operating expenses. Digital strategy and the correct segmentation strategy should complement existing phone resources.

Creating and executing digital campaigns that integrate successfully with current strategies takes analytics, strategic design, technology, and operational expertise.

Quanta provides these resources across the collections and recoveries industry, integrating with and expanding upon our clients’ existing systems. For organizations that do not know where to begin their digital collections journey or need help and resources, we will provide expertise, guidance and content to improve your results and the effectiveness of your collection operations.

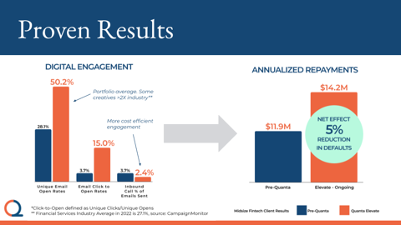

Quanta has seen email open rates over 50% in the early stages of delinquency and over 40% in the later stage recovery space.

This improved reach drives increases in non-phone transactions. Overall, we have seen our clients experience improved operational efficiency while reaching new incremental payers that the phone channel or basic email content and strategy have been ineffective in reaching.

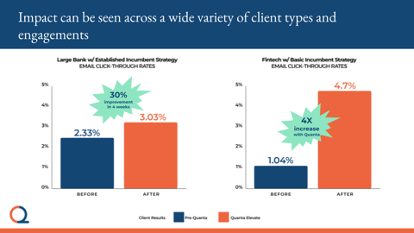

The improvement in the collections space using innovative digital strategy has been seen across issuer and debt types.

With experts in digital marketing, collections, analytics, compliance and technology, Quanta Credit Services is the definitive specialist in the digital collections and recovery industry. If you want to learn more about Quanta or schedule some time to discuss how you can avoid the post tax season fall off, visit us at www.quantacred.com or email us at contact@quantacred.com.

Jim Beck

Quanta Credit Services

Source Citations:

- 1

- 2TransUnion January 2023 Credit Industry Snapshot